Blog

Find a little bit of everything, from research highlights to use cases and how-to guides. Start browsing!

Featured posts

IAIP has honored ReSource Pro's own Gayla Martin with the prestigious prestigious Insurance Professional of the Year award - learn more about her achievements!

By

Resource Pro Editorial Team

Embedded insurance products are on the rise - should agents and brokers be concerned about these new solutions? How can distributors best respond and adapt?

By

Mark Breading

At insurance events, something is always happening between the diverse sessions, bustling vendor floor, and lively networking tables. While logos and banners dominated the event floor, the people were the

byResource Pro Editorial Team

Leading insurance companies – both carriers and MGAs – are investing in core systems to solve issues with market responsiveness and customer servicing. Find out about recent trends in our

byTom Benton

Throughout his career, Mark Breading has been known for his tailored advising, growth mindset, and commitment to guiding the next generation of insurance leaders. It comes as no surprise that

byResource Pro Editorial Team

In an evolving insurance landscape, Meredith Barnes-Cook explores how the "Five Whys" method can drive underwriting transformation, ensuring companies tackle root problems rather than symptoms.

byResource Pro Editorial Team

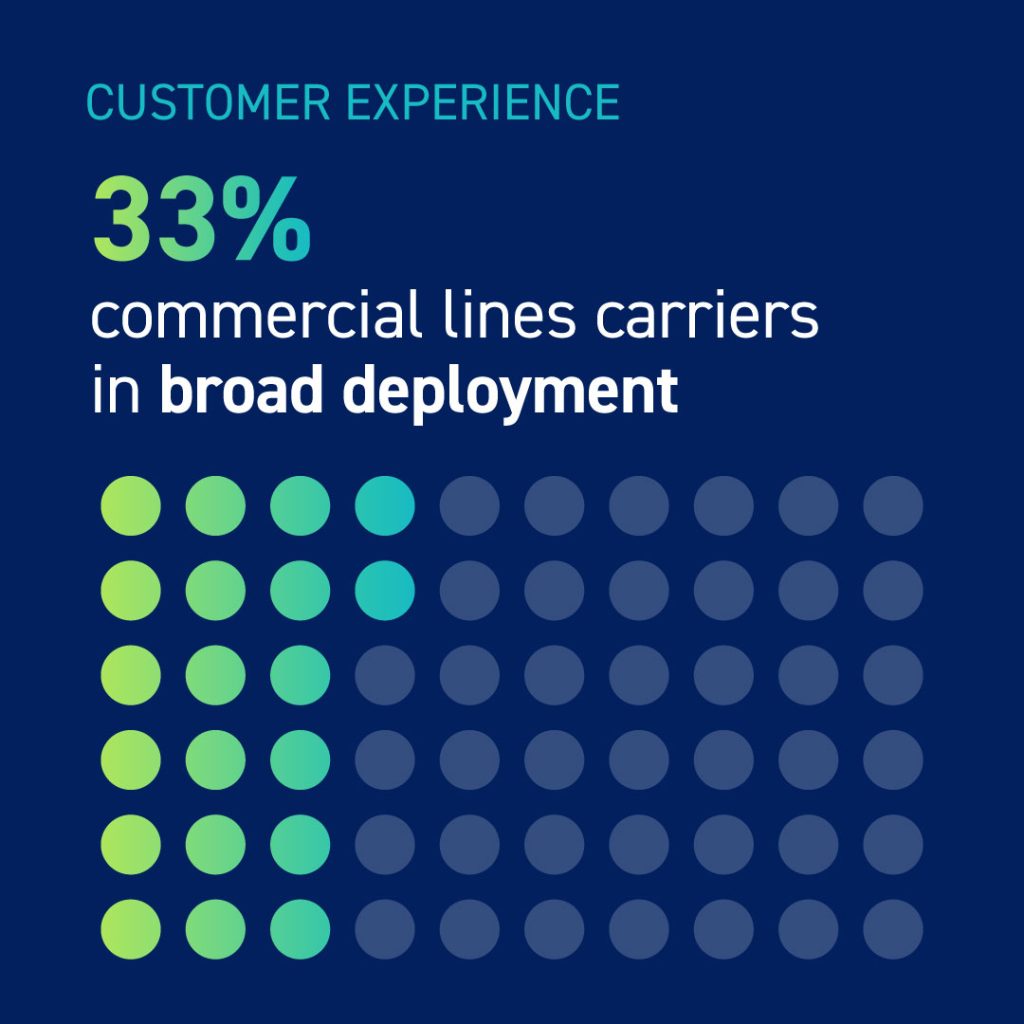

Over a decade, we've monitored shifts within commercial lines insurance. Recent economic variability, a talent crunch, climate changes, and tech advancements have heightened the stakes for 2024, urging carriers to

byMing Kostuck

Dan Epstein discusses the insurance talent crisis in Carrier Management, advocating for "up-sourcing" to address workforce gaps and retain knowledge. He highlights KPM as a key to operational efficiency and

byResource Pro Editorial Team

Amid a tough insurance market due to global factors, experts foresee mixed outcomes for 2024. With challenges like rising costs and the talent crisis persisting, firms must innovate and prioritize

bySusan Touissant

Today ReSource Pro Insights, our research practice, announces a big milestone: the release of our 300th published research report, "Embedded Insurance: Disruptor or Distraction?" From warranties to travel insurance, embedded

byMark Breading

The artificial intelligence (AI) landscape has changed significantly over the past year, presenting both fresh opportunities and new challenges to the property & casualty insurance industry. As AI continues to

byTom Benton and Vinay Shah

We’re excited to welcome Ernie Feirer in his new executive role leading our carrier practice. With more than 40 years of insurance industry experience, including 37 years of experience working

byResource Pro Editorial Team

You might be interested in

Let’s rethink your process together

We’re here to help you elevate your operations, allowing you to focus on your customers and business. Discover how we can help you thrive.