Insurtech Insights 2024: The human side of insurtech

At insurance events, something is always happening between the diverse sessions, bustling vendor floor, and lively networking tables. While logos and banners dominated the event floor, the people were the true focus of ITI.

The Insurance Futurist Shaping the Industry of Tomorrow

Throughout his career, Mark Breading has been known for his tailored advising, growth mindset, and commitment to guiding the next generation of insurance leaders. It comes as no surprise that Consulting Magazine has named him their 2024 Mentor of the Year, and we’re excited to share his thoughts on this recognition and the future of insurance.

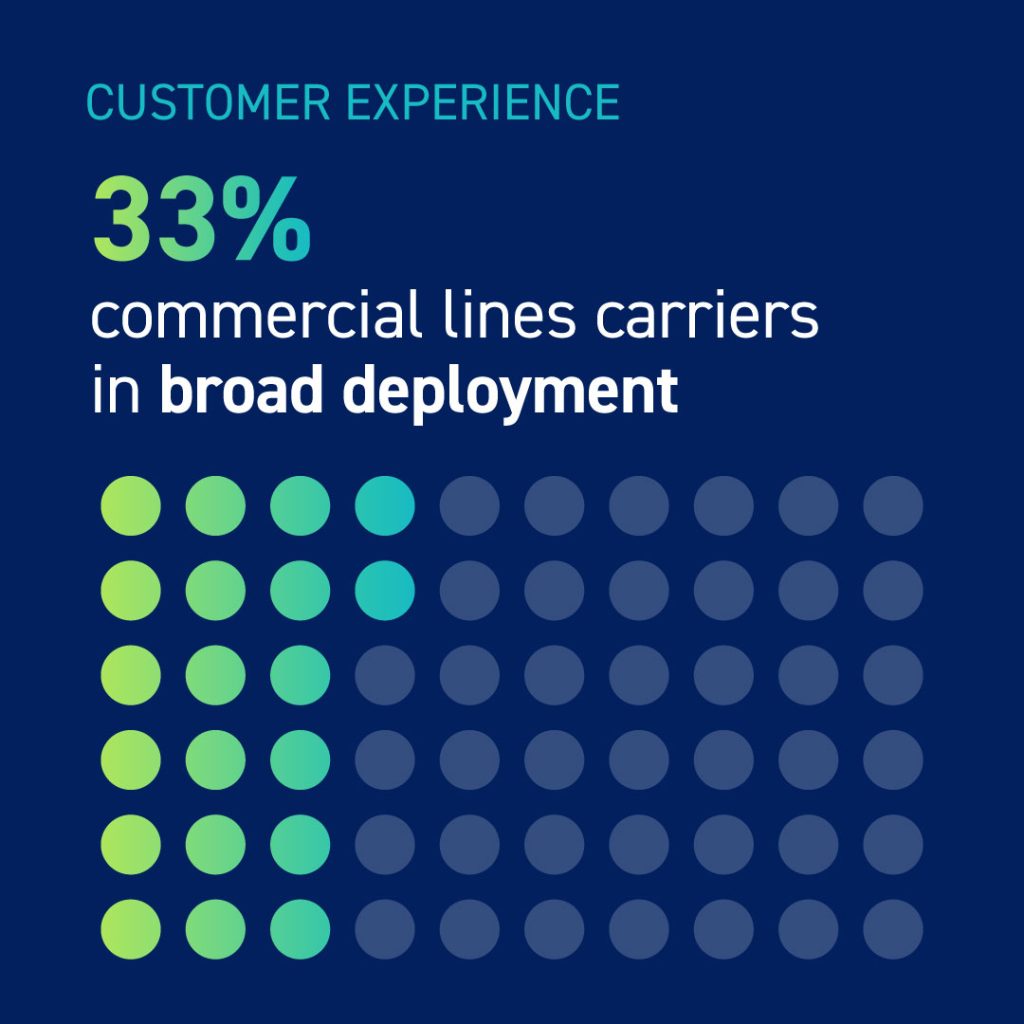

2024 Transformation Landscape: Commercial Lines Success Initiatives

Over a decade, we’ve monitored shifts within commercial lines insurance. Recent economic variability, a talent crunch, climate changes, and tech advancements have heightened the stakes for 2024, urging carriers to be both agile and insightful.

Carrier Management: CEO Dan Epstein on the Global Talent Crisis

Dan Epstein discusses the insurance talent crisis in Carrier Management, advocating for “up-sourcing” to address workforce gaps and retain knowledge. He highlights KPM as a key to operational efficiency and industry sustainability amidst rapid changes.

2024 Insurance Market Outlook for Retailers

Amid a tough insurance market due to global factors, experts foresee mixed outcomes for 2024. With challenges like rising costs and the talent crisis persisting, firms must innovate and prioritize human expertise to navigate future uncertainties and remain competitive.

Many see embedded insurance as a disruptor – is it?

Today ReSource Pro Insights, our research practice, announces a big milestone: the release of our 300th published research report, “Embedded Insurance: Disruptor or Distraction?”

From warranties to travel insurance, embedded insurance has been around for decades, but its potential impact is now being widely recognized.

Why is AI Governance Important for P&C Insurers?

The artificial intelligence (AI) landscape has changed significantly over the past year, presenting both fresh opportunities and new challenges to the property & casualty insurance industry. As AI continues to evolve, especially through advancements like GenAI, insurance companies must create strong governance frameworks to keep AI use transparent and ethical.

Welcome Ernie Feirer, New Carrier Practice SVP

We’re excited to welcome Ernie Feirer in his new executive role leading our carrier practice. With more than 40 years of insurance industry experience, including 37 years of experience working at two of the largest data and analytics providers in the insurance industry, Feirer is an exciting addition to our already strong bench of carrier-focused […]

New Digital Solutions are Transforming Insurance Distribution

Explore the transformative impact of digital solutions on insurance distribution in our new report. From addressing pain points like data enrichment to balancing technology with human expertise, discover insights that can reshape your distribution processes.

Technology Transformation for P&C Insurers: Hype or Hero?

P&C providers recognize the need to digitize, but these opportunities for growth come with major challenges. Mark Breading and Sabine Vander Linden explore the exciting changes and roadblocks insurers face.