Chris Watkins leads ReSource Pro’s Global Technology division, including information security, infrastructure, enterprise applications, and innovation, overseeing a team of over 120 technology professionals.

Questions on the road to automation and RPA initiatives

Automation can save you time, but it won’t always save you money. That’s the risk many insurance organizations unknowingly take when they jump at an automation solution without understanding the cost to customize or manage the technology. Yes, most company leaders know where, when, how, and why they can apply the technology, but when it comes to price, the true cost of the investment is rarely as obvious as it appears.

As the scope grows, so does the cost

While your organization may have a clear budget in mind at the outset of a new automation implementation, as you seek new areas to automate, the cost can easily surpass what you originally accounted for. Each small task requires a new bot, meaning you are more likely to end up building numerous bots than just one. In addition, the initial cost of development for each bot, while a one-time event, can be significant. Add them together, and it could take years to achieve a positive return. If you seek to develop robotic process automation (RPA) in-house, this may be unavoidable.

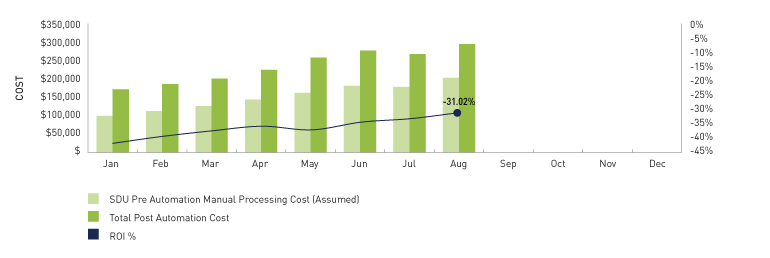

Below, you can see a sampling of our data on the cost of pre and post-automation processing. Note the ROI.

Bots require constant maintenance

Automation is rarely, if ever, a one and done investment. Even if your organization is prepared to cover the cost of development, bots break, and humans must always be on hand to monitor and fix them. Add constantly changing insurance procedures to the mix, and automation starts to require a much bigger human touch than many organizations first anticipate. But while maintenance can be expensive, it still doesn’t compare with that initial development cost.

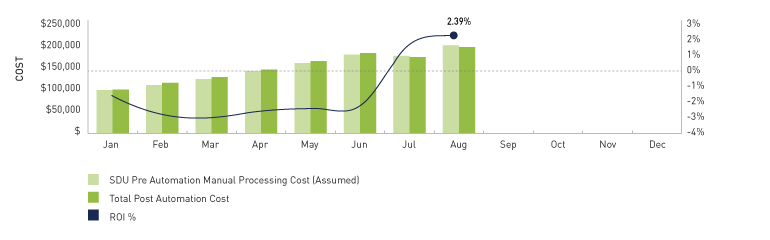

Below is the same data that we shared previously, but minus the development cost. See how our August figure has now risen by 33% and is in the black.

The ReSource Pro approach

As we’ve shown, achieving a positive ROI with automation can be difficult, particularly if you go it alone. Luckily, there’s a way to do it profitably—leverage a partner who will take the sunken costs for you. Not just any partner, but one with the scale and insurance expertise to make it a worthwhile and successful implementation.

ReSource Pro has deployed more than 700 bots for its clients. In our company-wide innovation program Advance it!, automation is consistently one of the most popular areas of development. To learn more about how we apply digital capabilities to insurance operations, visit our digital page or contact us.

Additional reading

Prepare Your Workforce for Automation

Best Practices for Developing an Automation Mindset Across an Organization