Brenda is a Senior Solutions Specialist at ReSource Pro

Of all the tasks insurance agency employees might consider mundane, policy checking is one of the most important items that tends to get short shrift. Checking policies for accuracy and completeness is commonly perceived as an administrative task, and as something with lower risk and priority that is performed after client servicing. As a result, many agencies use policy checking as a training ground for junior and early-career associates, and backlogs in completing policy checks are frequent. Unfortunately, this scenario is an errors and omissions (E&O) liability claim waiting to happen.

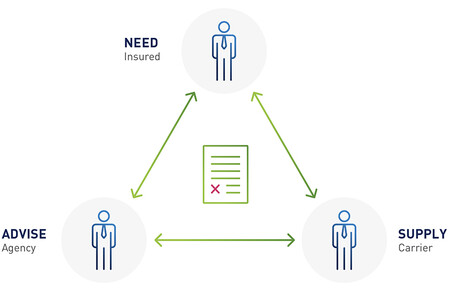

An insurance policy is the product that connects carriers, agents, and insureds. It not only is the means to providing financial protection to insureds but also the main source of agents’ revenue as well as the foundation of their relationships with customers.

THE POLICY TRIANGLE

Errors and omissions are costly exposures for agencies, and not just financially. Actions that give rise to E&O liability harm agencies’ relationships with customers and carriers. Losing an account due to an error or omission is unfortunate by itself, but a bad customer experience tends to get talked about, potentially impairing the agency’s reputation.

According to the Big “I,” one in every seven agents files an E&O liability claim annually. About 20% of E&O claims involve coverage-related issues, such as:

- Inaccurate or incomplete information provided to the carrier

- Failure to recommend coverage

- Failure to adequately identify exposures

- Failure to adequately explain policy provisions

- Failure to provide coverage

So, What’s the Problem?

Some of the common challenges involved in policy checking include:

- Priority. Often, policy checking falls to the bottom of the task list, which can lead to backlogs.

- Complexity. Numerous policy types and source documents, often differing from carrier to carrier, make the policy checking process complex.

- Uniformity and standardization. Agency standards are only effective if they are followed and enforced. Without these, silos can form.

- Predictability. It can be hard to maintain service standards and timelines.

- Visibility. Without an auditor on staff, agents typically have a limited view into how policy errors and discrepancies are handled.

- Actionability. Unless an agent can identify and understand problems in the policy checking process, corrective action will be elusive.

Is There a Better Way?

When performed properly, policy checking catches errors and coverage issues, and it ensures accuracy. Some common solutions to improve policy checking include:

- Checklists. A standardized, and repeatable, method for improving the accuracy and completeness of policy information is to create checklists. These can serve as valuable foundations for the policy checking process.

- Centralized process. Rather than conducting policy checking on an ad hoc or individual account basis, policy checking that is performed through a centralized process can be a good way to maintain consistency across accounts and different types of policies.

- Experienced staff. Often, junior staff are assigned repetitive tasks such as policy checking, but involving experienced staff is a better way to ensure accuracy.

Note that there are both limitations and downsides to these solutions. For example, a single checklist may not be applicable to all types of policies the agency handles. It is also difficult to audit the usage of the checklists and responses to the discrepancies found or to attain insights into error patterns. Similarly, changing or implementing new processes requires staff training, which must be repeated whenever new staff are involved in policy checking. Creating a centralized, standardized process can take time, which staff may find cumbersome. And shifting experienced staff to repetitive tasks could lead to employee burnout and reduced focus on higher-value work. Agencies need to balance these elements.

Standard procedures, followed consistently, are important not only to make sure the agent delivers what the insured has requested but also provide an important means of defending E&O litigation.

How Can ReSource Pro Help?

ReSource Pro’s Policy Insights is a tech-enabled solution that optimizes and analyzes the policy checking process, leading to minimized E&O risk, efficient agency operations, and an improved insured experience. In addition to providing agencies with accurate policy checking, Policy Insights empowers account managers with an online portal that allows them to review policies and address errors in just a few clicks. Operations leaders also gain access to an analytics dashboard, enabling them to view insights into carrier and account manager performance, error patterns, and E&O hotspots.

Download our eBook to learn what’s missing from most policy checking solutions and how Policy Insights can help.

Learn more about Policy Insights by visiting our webpage or scheduling a meeting.