Brenda is a Senior Solutions Specialist at ReSource Pro

Certificates of Insurance: More Complex Than They Appear

Every insurance agency that writes commercial insurance is familiar with customers’ requests for certificates of insurance. But what agencies may not realize is just how much time, effort, and risk responding to those requests and issuing certificates can entail.

When performed efficiently and accurately, certificate of insurance management and issuance can strengthen an agency’s relationship with its customers and enable them to pursue business opportunities that require evidence of insurance coverage. On the other hand, errors and delays in issuing certificates can frustrate customers and even cause them to lose contracts. That’s why it’s crucial for agencies to manage the risks and opportunities in the certificate process.

Certificates of insurance are more complex than they appear. When issuing a certificate, it’s possible to overlook or omit some coverage elements that might be critical to a customer winning a contract. If a certificate doesn’t reflect what is actually on the policy, not only could the customer lose a valuable business opportunity, but the agency may also incur errors and omissions liability.

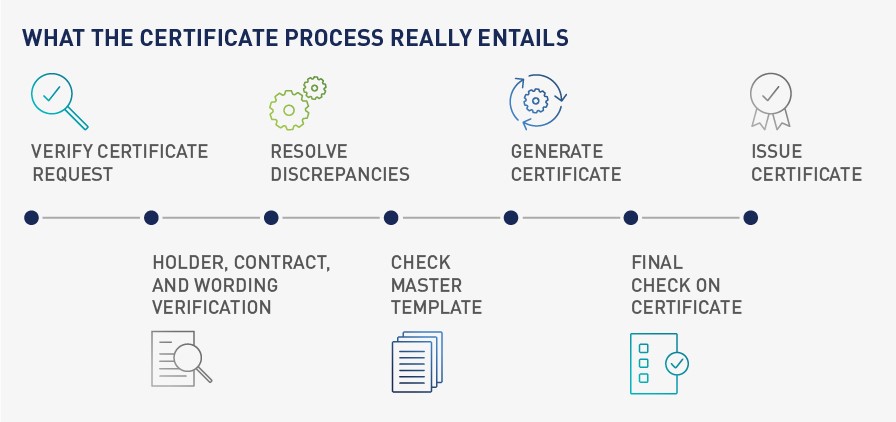

What Steps Are Involved in the Certificate of Insurance Issuance Process?

Many people—including agency employees and their customers—perceive the steps in issuing certificates to be simple.

In fact, issuing a certificate is often a lengthy process. One reason why is that the coverage elements and information needed for a single certificate can be complicated and sometimes require collecting data from many different systems. Exceptions can also arise, such as the need to verify premiums and renewal status. As a result, the actual certificate process can involve as many as seven steps.

Managing and issuing certificates of insurance can consume a significant amount of productivity for producers and other agency staff. In addition, demand for certificates can surge at any time, forcing agencies to prioritize requests and allocate additional resources to accommodate the workload. Understaffed agencies facing a backlog of certificate requests can find themselves in an untenable situation—with customer dissatisfaction a likely result. Fortunately, there is a solution to these challenges.

The Full-Service Certificate of Insurance Experience

ReSource Pro’s Certs Center provides agencies with certificate of insurance management and issuance support, helping them deliver accurate certificates quickly while freeing producers and customer service representatives to focus on higher-value tasks and avoid burnout. Some of the top benefits include:

- Fast turnaround. Deliver standard certificates of insurance and evidences of property insurance within 2–6 working hours.

- Consistent service. Through a standardized process, the Certs Center delivers consistent and high-quality service to agencies and their insureds. This approach also mitigates E&O risks.

- Agency branding. As a white-labeled service, the Certs Center puts the agency front and center.

- Financial flexibility. Our transaction-based model enables agencies to scale up or down as needed to accommodate fluctuating volumes.

- Triaging and tracking. Working with clients, the Certs Center establishes processes for responding to high-priority certificate requests, and our team tracks each step in the process.

- Knowledgeable professionals. The Certs Center team comprises professionals with significant insurance domain expertise as well as specialized training in certificates.

To learn more about how the Certs Center can make a difference for your business, visit our Certificates of Insurance page.