Insurance businesses historically have had two main paths to growth: organically and through acquisitions. Mergers and acquisitions continue at a rapid pace among insurance intermediaries. In 2021, brokers had a record year for M&A, and momentum continued in 2022. At the same time, rate increases and tightening in the admitted insurance market are causing more business to flow into excess and surplus (E&S) lines.

According to OPTIS Partners, which tracks agent/broker M&A, 2021 saw 1,034 deals, a 30% increase from 795 in 2020. More than three quarters of the deals in 2021 were backed with private equity, up from 70% in 2020.

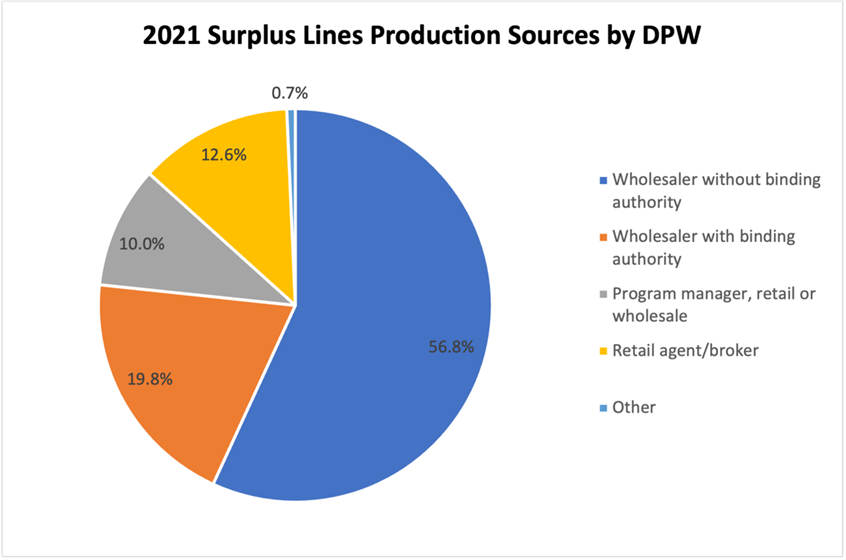

The distribution channel—comprising wholesalers, retail agents and brokers, underwriting managers, and managing general agents (MGAs)—is critical to the strength of the non-admitted insurance market. Retail and wholesale brokers are highly competitive and growth-oriented, which has a positive impact on E&S businesses. In 2021, the largest production source of non-admitted business was wholesale agents or brokers without binding authority—almost 57% of direct premiums written (DPW), according to A.M. Best. The second-largest production source was wholesalers with binding authority, at almost 20% of DPW.

Source: A.M. Best Company

Consolidation among distributors, however, represents challenges and opportunities for the non-admitted market.

Pros and Cons of Consolidation

The current trend in consolidation offers several pros and cons. The pros include:

- Scalability. M&A can help surplus lines businesses to scale their operations efficiently. By merging with or acquiring other entities, E&S organizations can expand their capabilities and footprint to serve more customers.

- Innovation. M&A involving technology-enabled startups can enable smaller E&S firms to bring innovation to their businesses cost-effectively. It often is easier to “buy” innovative operations than build them from scratch.

- Enhanced offerings. Larger brokers can use M&A to expand their scope of expertise and offer customers a greater range of coverage options. Greater specialization can fuel commission growth.

- Competitiveness. Hard market conditions and more selectivity by the admitted property and casualty insurance market tend to push more business into surplus lines. Players that grow their footprint and capabilities through M&A can gain a competitive edge in the non-admitted market.

For example, MGAs increasingly are looking to expand and improve underwriting results. They may look to merge with or acquire businesses in different geographies or technologies that enhance risk assessment. Similarly, wholesale brokers may engage in M&A to grow revenue by broadening the classes of business they serve or deepening their existing specialty areas.

The downsides of consolidation include:

- Economic headwinds. Broader economic conditions, such as inflation and rising interest rates, may make it more difficult for businesses to realize their return on investment goals.

- Regulatory scrutiny. While most M&A deals involve smaller firms, mega-deals tend to attract regulatory attention. For example, one recent proposed merger of two global insurance brokers appeared to be proceeding smoothly, until the U.S. Department of Justice intervened. Citing concerns about lack of competition, the department blocked the deal.

- Talent shortage. For surplus lines businesses owned by aging principals, M&A can become a succession strategy. This may signal a lack of interest among younger generations in pursuing insurance careers. Failure to attract and develop younger generations of insurance professionals could perpetuate the industry’s talent shortage.

- Compliance challenges. M&A or entering new markets often come with the challenge of complying with additional regulations. Licensing requirements, for example, are just one of the regulatory matters on which surplus lines distributors must focus.

Getting Help with M&A and Compliance

As M&A continues to be a popular growth strategy, ReSource Pro can help surplus lines businesses ensure fair valuations and maintain regulatory compliance. Learn more by visiting our Compliance page.