What most policy checking solutions are missing

Even for high performing agencies, policy processing requires considerable time and energy. Sharing work with partners can ease the load, but agencies often still have to handle the most challenging tasks.

In our experience partnering with insurance organizations, we’ve noticed that reviewing policy checks In working with clients, we’ve noticed that reviewing policy checks creates the biggest backlog for account managers. But what happens if that backlog grows too large, and the discrepancies uncovered by a policy check are never corrected? An agency could end up facing costly errors and omissions (E&O) lawsuits, not to mention a tarnished reputation.

Your policy check is only as good as the review. That’s why we created Policy Insights 2.0, a policy checking solution that can touch on every step of the process, enabling your agency to reduce its E&O risk, deliver policies faster, and empower staff to focus on revenue-generating activities, like cross-selling and up-selling.

How can Policy Insights 2.0 help operations leaders streamline and grow their agency?

Policy Insights 2.0 gives operations leaders an easy-to-use analytics dashboard, allowing them to monitor policy processing in real-time, track and measure account manager performance, and identify top sources of errors and omissions risk. Using this data, operations leaders can better understand of their carrier relationships, lines of business, and account manager effectiveness, helping them make strategic decisions to improve customer experience and drive growth.

How can Policy Insights 2.0 make life easier for account managers?

With our online Account Manager Portal (AMP), account managers gain the ability to:

- Monitor the policy checking process in real-time

- Easily review and make decisions on discrepancies found during the check

- Quickly request agency management system updates

- And rapidly request endorsement corrections

All in just a few clicks, ensuring your clients receive an accurate policy as fast as possible.

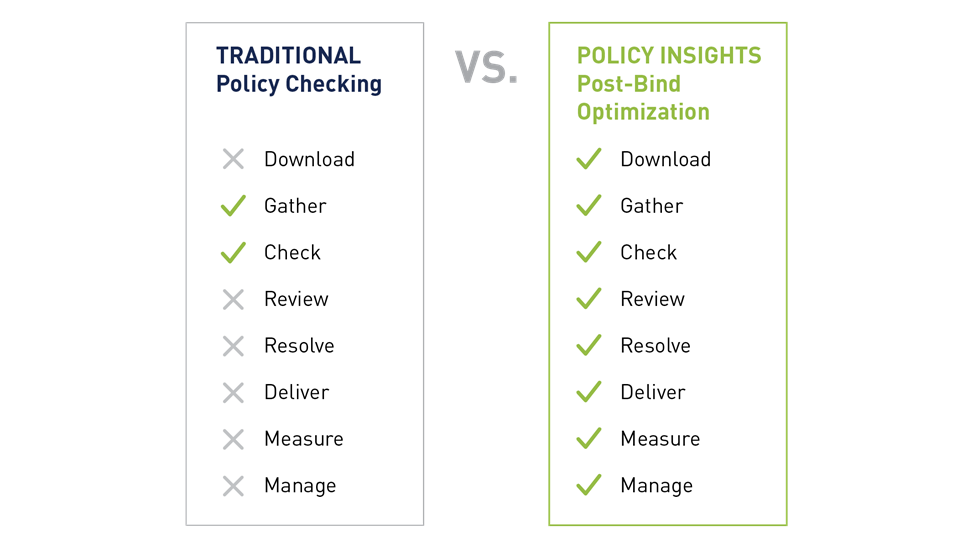

How is Policy Insights 2.0 different from other policy checking systems?

Many agencies report that the most critical and costly step keeping them from growth is not policy checking, but policy review—yet few solutions on the market address this pain point. Policy Insights 2.0 combines automated policy checking and experienced insurance professionals to enable vertical integration through the post-bind value chain.

So, when you are ready to optimize your post-bind operations even more, Policy Insights 2.0 is ready to help take you to the next level.

Additional benefits include:

- Access to trained insurance staff

- 99.9% accuracy with human verification

- Seamless integration with your AMS workflows

Ever thought of your policy checking process as a strategic advantage? Request a demo.