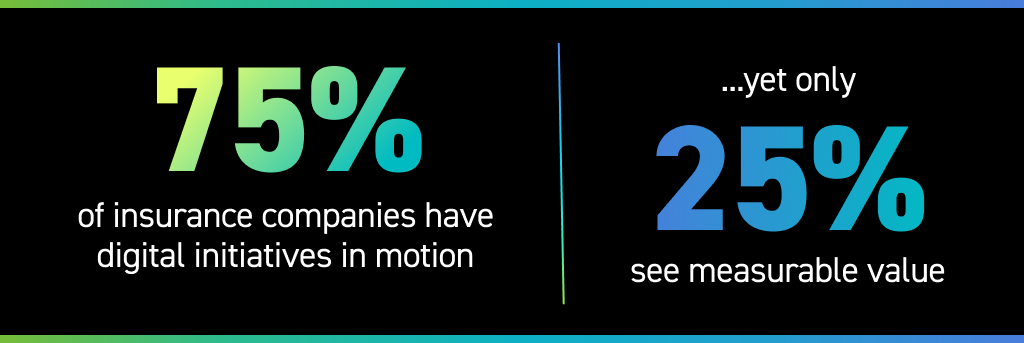

In today’s insurance landscape, it’s no secret that digital transformation is top of mind for most organizations. Yet, despite heavy investments, most insurers aren’t realizing its full potential. According to BCG Consulting, while 75% of insurance companies have digital initiatives in motion, only 25% see measurable value. So, what’s holding organizations back? The answer often lies in the foundation. Before introducing automation or advanced technology, insurers must first gain visibility into how their operations truly work. That’s where Lean process mapping comes in.

What is Lean process mapping?

Lean process mapping in insurance operations is a proven Lean management tool that breaks down how work flows across people, teams, and systems. It helps insurers improve workflows, reduce waste, and create a path for digital success.

Whether it’s prospecting, submissions, quoting, or claims, Lean process mapping applies across the insurance value chain. In our experience, it’s especially powerful for high-volume, repetitive processes that require accuracy and coordination across teams. When insurers see how work gets done, they can begin to streamline insurance workflows, boost quality, improve communication, and deliver better customer experiences.

Why does Lean process mapping and standardization matter?

A digital strategy is only as effective as the processes behind it. If your workflows are inconsistent or poorly documented, digitizing them only serves to magnify the problem. Insurance Lean process mapping ensures that:

- Leaders and staff share a unified view of how processes function and where improvements can be made.

- Processes are performed consistently, driving quality and fostering a culture of continuous improvement.

- Documentation creates clarity for training and onboarding.

- Teams feel more engaged and confident in their roles.

In short, it builds the operational efficiency necessary for digital transformation to succeed — not just today, but in the future.

How do you execute a Lean process mapping project?

Launching a Lean process mapping initiative starts with an inventory of your organization’s operations. Understand your divisions, the processes they own, and the roles involved. Look at factors like frequency, volume, complexity, and service level agreements. This upfront effort helps you prioritize which processes will deliver the most impact when optimized.

Next, choose the process you wish to map, define its scope, and gather the right stakeholders for the mapping session. Key steps in a lean process mapping project include:

- Mapping the current state

- Identifying improvement opportunities

- Prioritizing and sizing opportunities

- Developing a realistic improvement plan

- Establishing KPIs to measure success

Keep in mind that this is not a quick fix; mapping sessions can last from a few hours to several days. While it’s an investment of time and resources, the cost savings and efficiency gains drive insurance process optimization.

Real-World impact: One client’s journey

A high-net-worth personal lines broker turned to Lean methodology to strengthen their insurance operations from new business through renewal. Through an intensive end-to-end process review, we mapped 16 processes and identified 93 improvement opportunities.

After review, leadership prioritized and implemented 75 of the improvements, achieving immediate efficiency gains and long-term scalability. Lean process mapping provides the clarity, structure, and action plan needed to transform insurance processes in measurable, sustainable ways.

Partnering for success: ReSource Pro’s Lean process mapping expertise

If you’ve never facilitated a Lean process mapping session before, the process can feel overwhelming. That’s where a trusted partner helps. At ReSource Pro, our insurance operations experts combine deep industry knowledge with Lean management in insurance to guide your teams through the entire process. This allows you to create a future state plan that maximizes your resource utilization and reduces operational costs.

We help insurers overcome the most common barriers to digital transformation: misaligned leadership, fragmented systems, inconsistent processes, and unrealistic AI expectations. With lean process mapping, we build a strong operational foundation first, ensuring your digital strategy delivers real results.

Ready to unlock the power of lean process mapping in your insurance digital transformation? Visit our solutions page to learn how ReSource Pro can help you standardize, optimize, and transform with confidence.