In the insurance industry, there is perhaps no buzzier word than “innovation” – except for maybe AI, of course. The industry’s focus has been glued on adopting innovative technologies and distribution approaches to stay competitive, enhancing customer experiences, streamlining operations, and developing new products. However, in recent years, a new business driver has taken over innovation as the top motivator for carrier executives to invest in new emerging technologies.

The shift toward optimization

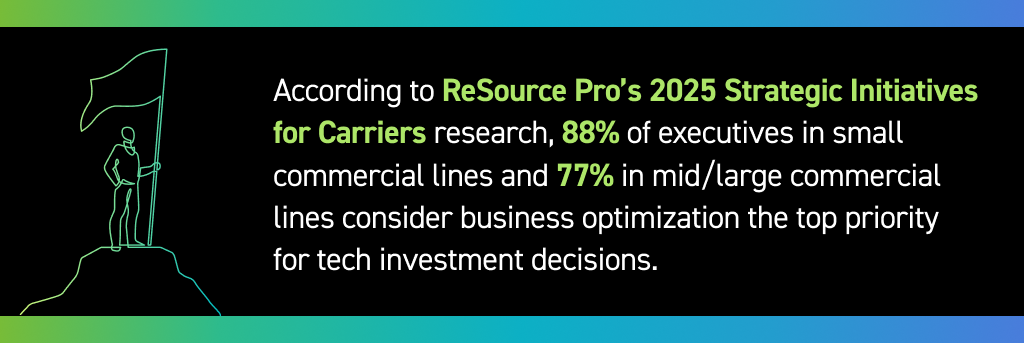

While innovation has gradually become more important to executives year after year since 2020, it is optimization that has impacted how companies innovate, making it vital for insurers to understand. According to ReSource Pro’s 2025 Strategic Initiatives for Carriers research, 88% of executives in small commercial lines and 77% in mid/large commercial lines consider business optimization the top priority for tech investment decisions. This is a considerable shift from 2023, when only about half of commercial lines executives deemed business optimization a top driver. Although there has been a slight decrease in business optimization prioritization in the mid/large segment since 2024, the overall trend reflects a broader recognition of the need to streamline processes, reduce inefficiencies, and leverage data analytics for better decision-making.

The role of emerging technologies

Today, carriers increasingly invest in technologies such as artificial intelligence, machine learning, and robotic process automation to automate routine tasks and improve customer service. These technologies enhance operational efficiency and enable carriers to offer more personalized products and services, thus improving customer satisfaction and retention.

But as carriers pursue more business optimization, where does that leave their plans for innovation? During the pandemic, strategies that drove innovation were sidelined as companies focused on business sustainability, but now, innovation is gradually finding its way back to the center stage and becoming a more significant driver of technology decisions. So now the task carriers face is rethinking their strategies to ensure they are leveraging technologies to optimize operations while also fostering innovation to maintain a competitive edge. The answer might not always be the same, as sometimes more traditional initiatives must take precedence over the transformational.

Development phases of strategic initiatives

Our 2025 Strategic Initiatives research shows that some more innovative initiatives, like deploying AI technologies or new business models, are in earlier development phases compared to more fundamental plans, such as talent development or customer experience modernization. At the same time, initiatives that drive efficiency and optimization, such as data and analytics, are front and center in commercial lines executives’ agendas.

Conclusion: Finding the right balance

As we progress through this year and into the future, it will become increasingly imperative for commercial lines carriers to find the right balance of active strategies that drive optimization without compromising innovation. Those that do will be well-positioned to thrive in an increasingly competitive insurance market.