Most insurance professionals understand that failing to meet insurance compliance obligations can result in censure by regulation authorities. Often, however, they underestimate the real harm such penalties can do. One definitive source for hard numbers across our industry is the NAIC’s Insurance Department Resources Report, Volume 1. Published annually, this report brings together a wealth of information about the operation of the state insurance departments—including administrative reviews and actions taken against insurance companies and licensed producers.

Let’s review some key statistics for 2021 and compare them to the previous year’s findings. Sharing this information with both decision-makers and front-line employees can bring home the real financial impact of regulatory actions. Increasing this awareness can then help generate buy-in for a culture of compliance at your insurance business.

The cost of non-compliance for licensed individuals and entities

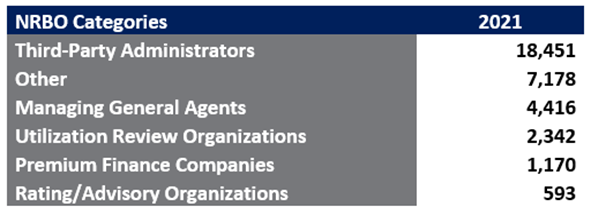

In 2021, 12.1 million individuals and entities were licensed to provide insurance services in the United States. This total includes individual and entity licensees as well as certain non-risk-bearing organizations regulated by the insurance department.

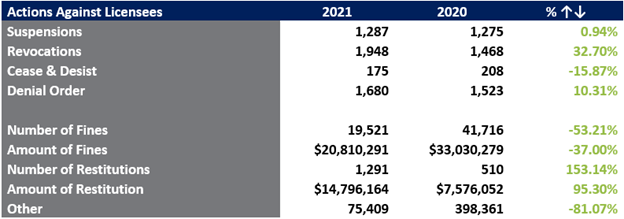

The number of license suspensions imposed by the state insurance departments remained relatively stable. The number of revocations, however, grew by nearly 33% from 2020 to 2021. This is significant because the process for reinstating a revoked license—if possible—is typically more expensive and time-consuming than accommodating a temporary suspension. Additionally, although the total number and amount of fines decreased slightly, the number of restitution orders rose by 153.41%. The amount of restitution nearly doubled from $7.6 million to $14.8 million.

The NAIC’s report does not disclose the circumstances prompting the DOIs to enact sanctions. Thus, we cannot say whether this increase reflects greater severity on the part of regulators or a change in the seriousness of licensees’ offenses. We can say that any regulatory action must be reported promptly to all jurisdictions where the individual or entity is licensed. Additionally, applicants must disclose this information on future license applications. Having a regulatory “history”—especially a license revocation—increases the chances of a lengthy legal review. It may even result in regulators denying license applications or renewals. Of course, the nature of the violation ultimately determines the outcome.

The cost of non-compliance for insurance companies

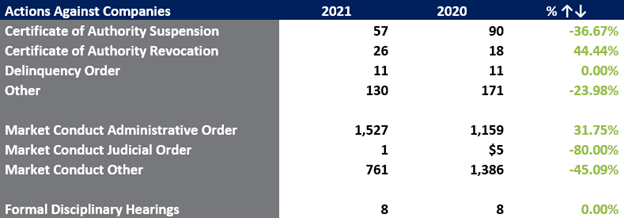

State insurance departments also imposed regulatory actions on insurance companies. This includes domestic and foreign insurers as well as domiciled self-insured groups/pools and domiciled purchasing groups.

Although directed at insurers, these actions often have a “trickle-down” effect on agencies if licensees represent products underwritten by that company. Even if a company does not lose its certificate of authority, the costs involved with the investigation and remediation of non-compliance can impact its overall profitability. (The NAIC report contains additional data on companies under supervision or in receivership for financial instability.) Insurers struggling with such issues may be less able to support their current product offerings or to expand into new product lines or additional territories.

Compliance resources for insurance professionals

The ReSource Pro blog offers numerous articles on how to respond appropriately to specific non-compliance situations. Our team of compliance experts is available to handle regulator notifications for our clients and to help individuals and entities with less-than-perfect regulatory histories navigate the licensing and renewals processes successfully. We also provide a comprehensive range of licensing, corporate compliance, and surplus lines business solutions to support future compliance.