The excess and surplus lines (E&S) insurance market has long been a source of solutions for companies with emerging and difficult-to-place risks. The steady growth in E&S premium volume over the past two decades and specialized nature of coverages make non-admitted business attractive for agencies and brokerage firms.

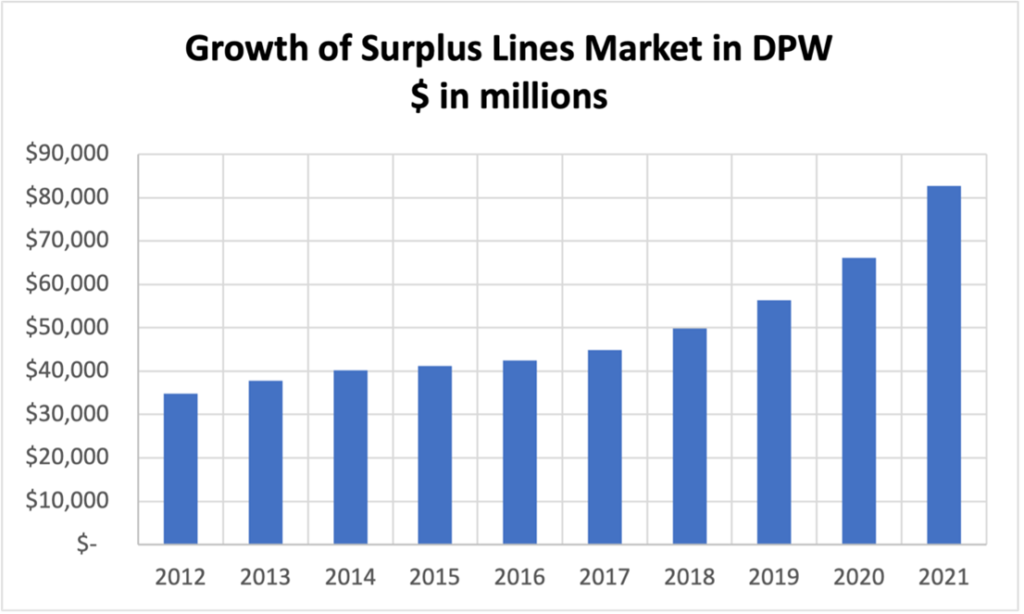

In 2021, the U.S. surplus lines industry hit a record high of almost $82.7 billion in direct premiums written (DPW); this was the largest year-over-year increase in premium volume since 2003. What’s more, the share of E&S premiums as a percentage of total property and casualty direct premiums written more than doubled over the past 20 years, to 10.1% at year-end 2021. In 2001, surplus lines DPW accounted for 4.3% of total P&C DPW.

Growth of Surplus Lines Market in direct premiums written.

Source: A.M. Best

Rapidly evolving risks drive growth

The growth of the surplus lines market appears likely to continue well into the future, with rapidly developing businesses and emerging risks. For example, three evolving markets include:

Cannabis industry. Across the U.S., various forms of cannabis are legalized and regulated for non-medical or recreational use. Medical marijuana is permitted in more than three dozen states. According to DISA Global Solutions, as of October 2022, cannabis is fully illegal in only four states: Idaho, Kansas, South Carolina, and Wyoming. Cannabis is fully legalized in 19 states. In the remainder, cannabis is legal in part for medical or recreational purposes or is decriminalized.

The cannabis industry is rapidly evolving at all points in the product lifecycle, from growing operations to distribution systems to retail dispensaries for cannabis products. A “shadow economy” of businesses in the cannabis supply chain may not fully grasp their need for, or the availability of, insurance protection.

Although states have relaxed laws restricting the use of cannabis, it remains a Schedule 1 drug under federal law. As a result, banks worried about regulatory uncertainty have avoided serving cannabis businesses, as have admitted insurance companies. Legislation pending in Congress would provide legal protection for banks and insurers that do business with legal cannabis entities. That legislation could lead to more growth opportunities for agents, brokers, and insurers. This is especially true for surplus lines, which can introduce new coverages faster and easier than admitted insurers because of regulatory requirements.

Even if federal legalization occurs, it might prove highly disruptive to the current cannabis industry and its regulation. If so, the non-admitted insurance market will play a key role in insuring this industry for an even longer period, extending opportunities for growth.

Cyber liability. Cyber insurance solutions first appeared as part of surplus lines insurance. As demand for protection increased, admitted insurers began underwriting cyber risk. Increasing cyber event losses, especially from cybercrime like ransomware attacks, has hardened the market. Several factors contributed to the surge in losses, including the massive shift to remote work, increased reliance on networked devices, and political unrest.

Cyber liability is a growth opportunity for the insurance industry, not only because of the rise in losses but also because of legislation raising requirements for cybersecurity and data privacy. As more organizations handle or process sensitive customer data, liability coverage is crucial to protect against data breaches.

The surplus lines market is ideally suited to address coverage gaps and to introduce new products for an increasingly digital economy.

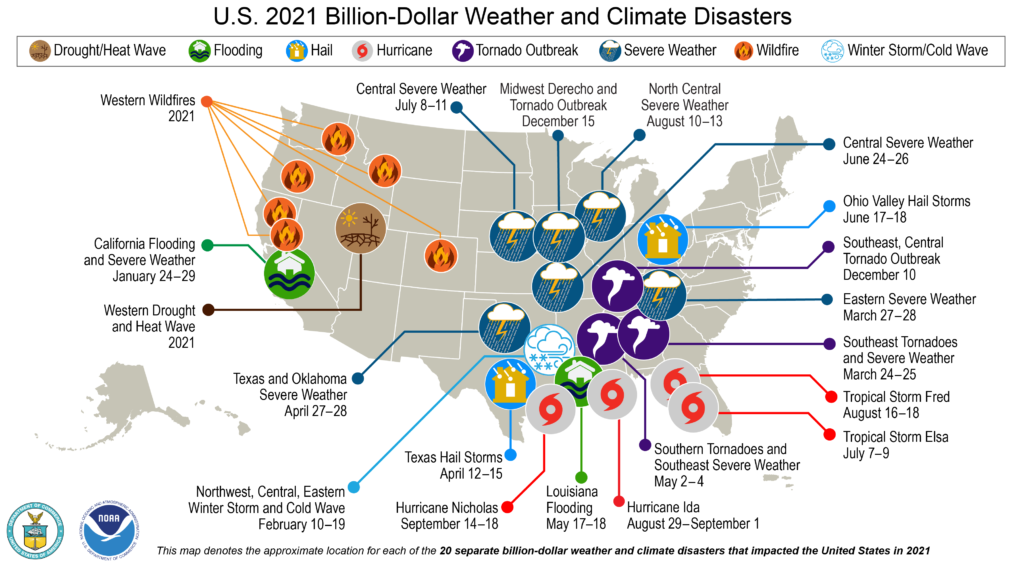

Climate change. As billion-dollar weather events and climate-related losses occur with greater frequency—including floods, windstorms, drought, and wildfires—communities and businesses in many areas are experiencing losses and need protection. In 2021, 20 climate events caused more than $1 billion in losses – the second highest number ever recorded, behind 22 in 2020.

Source: NOAA

Surplus lines insurance can play an important role in mitigating the impact of losses due to climate change. Government-backed programs, such as the National Flood Insurance Program, face steep financial challenges, making private insurance more attractive. Amid global supply chain issues and inflation, recovery efforts following disasters are happening slower and becoming more expensive. The surplus lines market offers an efficient way to create innovative and customized products that meet P&C customer needs.

Opportunities abound for agencies that are prepared to handle the specific compliance requirements of the surplus lines market—including licensing, underwriting, policy filings, and premium tax payments. For more information on how ReSource Pro provides expertise and a proven infrastructure for those looking to move into surplus lines, please visit our Compliance page.