Governance is a critical part of any business, whether it’s a small startup or a global enterprise. A solid governance structure can have a range of benefits, from attracting investors to ensuring a business stays on course during a crisis, or even helping create strategies for continued growth and resilience. But what is governance and how can insurance organizations implement it effectively?

What is governance?

Governance refers to the practices, processes, and policies that help you guide your business in the right direction, ensuring it runs smoothly, meets its objectives, and stays out of regulatory trouble. It’s helpful to think of it like this: Governance is about the time you dedicate to working on your business, rather than in it. When you work in the business, you’re only working on today’s income. When you work on the business, you’re working to address larger, more strategic issues to secure tomorrow’s revenue.

Why is governance important?

Governance sets the tone for a business. It isn’t just about ensuring financial success and longevity, it’s also about guiding and supporting the character of a business. In fact, good governance has many benefits, it can help a business thrive in the following ways:

- Improved business performance. Governance creates a clear vision for the organization, supports faster and safer revenue growth, and creates a competitive advantage.

- Reduced risk and cost. Governance allows you to identify current risks and provide insight into future risks. It can also define strategies for risk mitigation and eliminate opportunities for fraud, dishonesty, or mismanagement.

- Enhanced compliance. Governance enables you to better understand your legal responsibilities—especially when they change; reduce time, money, and effort on compliance, and ensure accountability for what’s happening at an operational level.

- Better engagement of customers and employees. Governance helps manage conflict, especially in family businesses or those in which ownership is shared. It also provides an opportunity to show your customers your business is responsible and ethical as well as prove to investors that you’re doing things sensibly and safely.

How can you get started with governance?

Laying the groundwork for good governance in your insurance organization starts with introducing the proper tools and resources to document your plans, involve the right people, set up good communication, and track your performance. Here are a few useful tools you can use to address each of these areas.

1. Documenting your plans

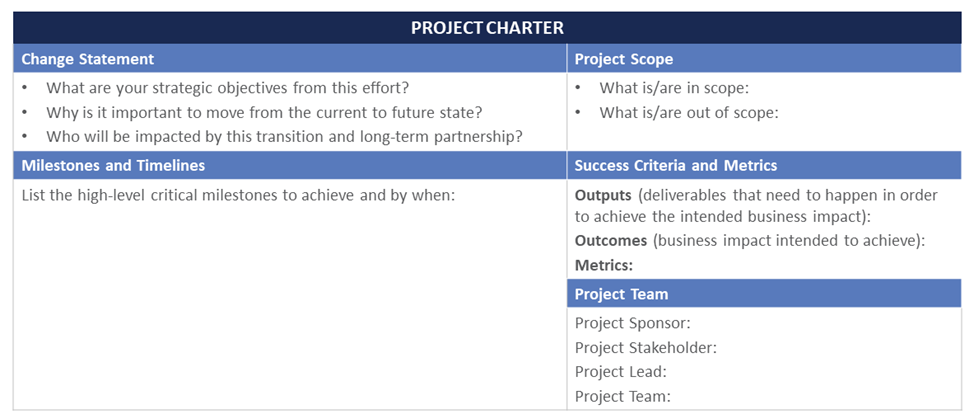

Two tools are particularly useful when it comes to project governance: a project charter and project plan. The purpose of a project charter is to document an overview of a project, the timeline, metrics, and team. Completing a charter enables you to establish the scope of the project, define objectives, and gain a vision for success.

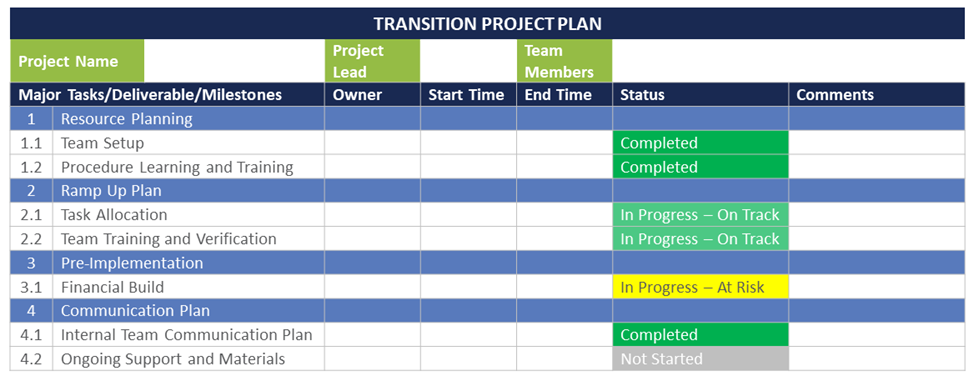

The project plan is where things become more granular. This tool is utilized to identify the key tasks and the sub tasks for the project, including owners and the due date, in a visual format. The project plan can be owned by the project lead, or if there are smaller project committees, they can update and track the key deliverables they are responsible for.

2. Involving the right people

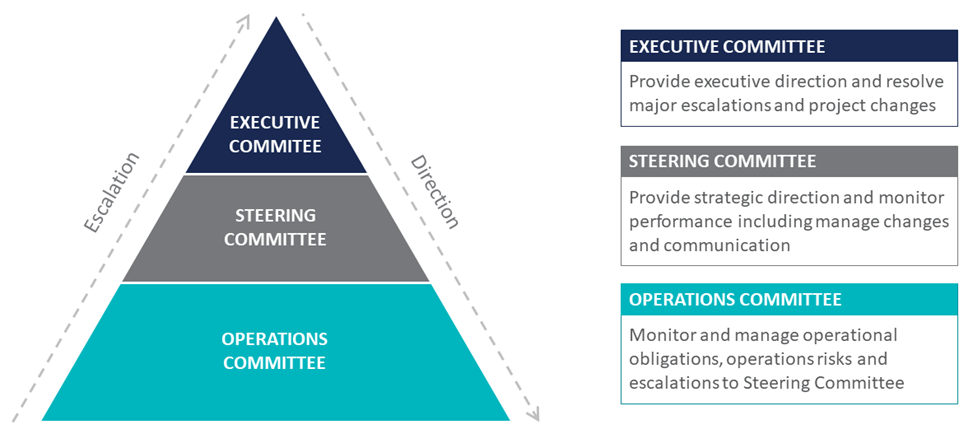

Successful project governance ensures that you are involving the right people and that they have clear roles and responsibilities. The below template can be utilized to align roles and responsibilities, not only throughout the life of the project but also during steady state.

3. Setting up good communication

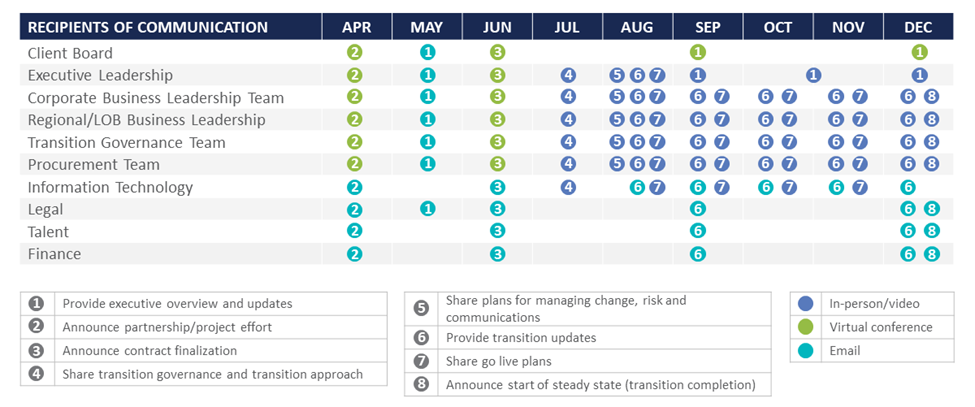

Establishing a communication schedule can help you maintain visibility and alignment throughout the implementation of the project plan. Below is an example schedule. Note how the method of communication is detailed. Not every update requires an in-person or video meeting!

4. Tracking your performance

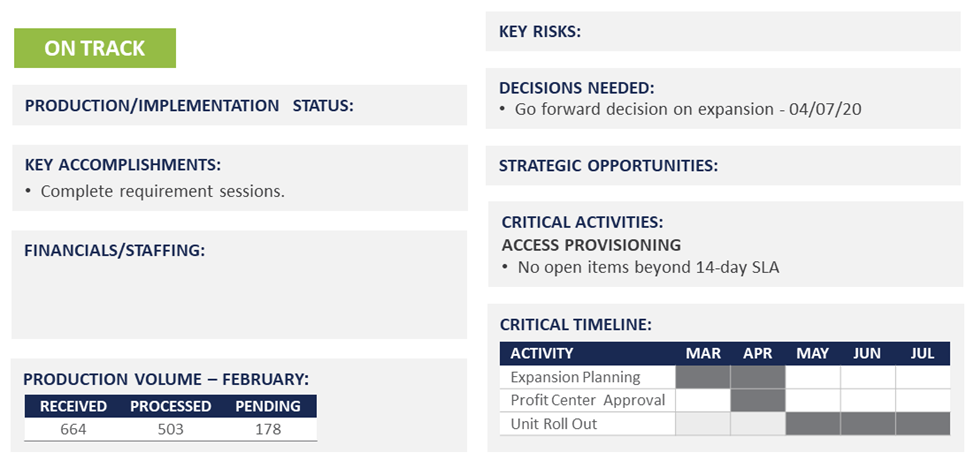

Compiling a monthly report is key to keeping track of your progress throughout a project, including any new accomplishments, risks, and opportunities. Below is an example monthly report.

Take the next step in building or improving your governance

Governance is important at every stage of your business. It’s never too early or too late to start thinking about governance or how to improve it. So, when it comes to working on your business remember to mind your P’s: Proper, Planning, Prevents, Poor, Performance.

Need help with your insurance organization’s governance? ReSource Pro Consulting can support you in profiling your governance functions, defining governance criteria for a new initiative, or identifying the optimal governance structure for you. Contact us to learn more or visit our Consulting page to find out more about our transformational solutions.