In today’s competitive insurance landscape, efficiency is paramount. Carriers, MGAs, and retail agencies are constantly challenged by high operational costs, inefficient workflows, and the administrative burden that bogs down expert teams. Repetitive tasks consume valuable time that could be spent on underwriting, building agent relationships, and driving growth. The key to unlocking higher productivity lies not in working harder, but in working smarter through insurance BPM services that streamline and optimize core business processes.

This is where a strategic partnership for insurance BPO services becomes a powerful catalyst for transformation. By outsourcing key operational processes to an insurance-exclusive expert, you can reduce expenses, improve the speed and accuracy of core functions, and gain access to advanced technology without the massive capital investment. This guide explores the strategic framework for implementing BPO to achieve sustainable growth and a distinct competitive advantage.

What Are Insurance BPM Services? A Strategic Overview

Business Process Management (BPM) for the insurance industry involves delegating specific operational functions, from policy checking to claims setup, to a specialized third-party provider. However, the modern approach has evolved far beyond simple task delegation. It has become a form of strategic process management, where a partner not only executes tasks but actively works to optimize them.

This evolution distinguishes between two core areas:

- Back-Office BPM: Administrative and support functions that are critical but not customer-facing, such as data entry, policy checking, and report generation.

- Front-Office BPM: Customer-facing activities like First Notice of Loss (FNOL) intake and policyholder inquiry management.

Crucially, the insurance industry’s complexity, regulatory nuances, and unique terminology demand more than a generic BPO solution. A partner with an insurance-exclusive focus understands the intricacies of your business, ensuring seamless integration and compliant, accurate execution.

From BPO to BPM: A Strategic Approach

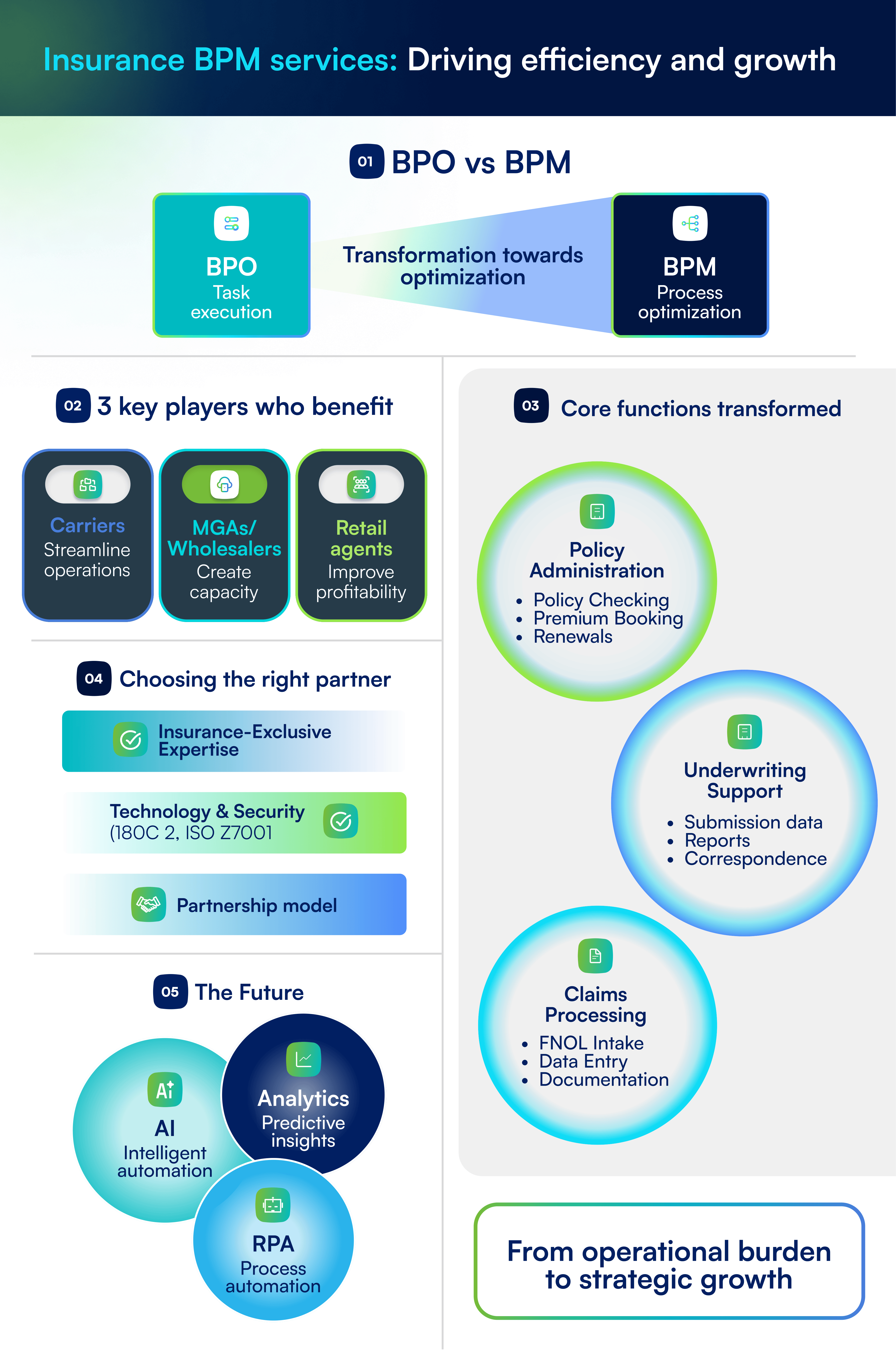

It’s important to understand the relationship between Business Process Outsourcing (BPO) and Business Process Management (BPM).

- BPO is the strategic decision to delegate a business process to an external partner.

- BPM is the holistic discipline of analyzing, optimizing, and continuously improving that business process for maximum efficiency and effectiveness.

A transactional vendor simply performs the BPO task. A true strategic partner, however, delivers BPO services through a BPM lens. They don’t just take over a process; they re-engineer it. This partnership model combines the immediate capacity benefits of outsourcing with the long-term value of ongoing process improvement, ensuring your operations become more streamlined and resilient over time.

Key Players in the Insurance Value Chain Who Benefit

A strategic BPO partnership delivers value across the entire insurance ecosystem:

- Carriers: Streamline core operations from underwriting support to claims processing, reducing operational overhead and enabling a sharper focus on risk assessment and product innovation.

- MGAs/Wholesalers: Create significant capacity to support growth, improve service levels for retail agents, and process submissions and renewals faster.

- Retail Agents: Improve profitability and service by offloading time-consuming administrative burdens like certificate issuance and policy checking, freeing up licensed staff to sell and advise clients.

Core Insurance Functions Transformed by BPO Services

The most impactful insurance BPO services target high-volume, rules-based processes where efficiency and accuracy are critical. By outsourcing these functions, organizations can achieve immediate operational lifts and empower their in-house experts to focus on higher-value work.

Policy Administration and Servicing

The policy lifecycle is filled with essential but often repetitive administrative tasks. A BPM partner can manage these functions with precision and scale.

Key Tasks: Policy checking, premium booking, endorsement processing, renewal preparation, and final policy issuance.

Business Impact: Ensures data accuracy from submission to renewal, reduces E&O risk, and accelerates the delivery of policies and documents to clients and agents. For example, a partner can meticulously check a 200-page policy against the quote and binding documents, catching errors before they become costly problems.

Claims Processing Support

Reducing claims cycle times is critical for both customer satisfaction and loss adjustment expenses (LAE). BPM services can offload the administrative weight from your adjusters.

Key Tasks: First Notice of Loss (FNOL) intake and setup, claims data entry and verification, and documentation management (e.g., attaching photos, reports, and correspondence to the claim file).

Business Impact: Allows adjusters to focus on investigation, evaluation, and settlement—not data entry. This accelerates the entire claims process, improves data consistency, and reduces administrative overhead.

Underwriting Support

Underwriters are among the most valuable experts in any insurance organization. BPM helps protect their time by handling the preparatory and administrative work that precedes risk analysis.

Key Tasks: Gathering and organizing submission data, clearing applications for completeness, ordering third-party reports (like MVRs and loss runs), and managing underwriting correspondence.

Business Impact: Creates a clean, complete, and organized submission file, allowing underwriters to make faster, more informed decisions. This directly increases submission throughput and allows your organization to write more profitable business.

The Strategic Benefits of Outsourcing Insurance Operations

Beyond simple task execution, a true BPM partnership delivers high-level business advantages that drive growth, agility, and a stronger bottom line.

Cost Optimization and Efficiency Gains

Outsourcing converts the fixed costs of staffing, training, and office space into a variable operating expense, allowing you to pay only for the services you need. A specialized provider also brings economies of scale, leveraging optimized workflows and trained staff to perform tasks more efficiently and at a lower cost per transaction than most in-house teams can achieve.

Scalability and Business Agility

The insurance market is cyclical. A BPM partner gives you the power to scale your operations up or down instantly to meet demand without the challenges of hiring or laying off staff. This agility is invaluable for handling seasonal peaks (like renewal seasons), managing catastrophic events, or quickly launching a new product line and needing immediate processing support.

Access to Expertise and Technology

A strategic partner invests heavily in the two things that drive modern operational excellence: people and technology.

- Expertise: You gain immediate access to a workforce that is already trained and specialized in insurance processes and terminology.

- Technology: You can leverage your partner’s investment in advanced platforms, including Artificial Intelligence (AI), Robotic Process Automation (RPA), and data analytics, without needing to build or buy these tools yourself. This powerful synergy of expert people and proprietary technology mitigates risk and ensures your operations are built on a foundation of proven security and compliance frameworks.

How to Choose the Right Insurance BPM Partner: A Checklist

Selecting a provider is a long-term strategic decision. The right partner becomes an extension of your team, while the wrong one can create new operational headaches. Use this checklist to evaluate potential partners.

Verify Insurance-Exclusive Expertise

The single most important factor is deep industry knowledge. A generic BPO provider simply cannot grasp the nuances of insurance regulations, terminology, and workflows.

Ask: Does the provider serve only the insurance industry? Can they provide client case studies specific to your market segment (e.g., commercial lines carrier, MGA, or retail agency)? Do their team members hold insurance-specific designations?

Evaluate Their Technology and Security

A modern BPM partner is also a technology partner. Their platform should enhance efficiency and integrate seamlessly with your systems.

Ask: What is their approach to AI and automation? Can they demonstrate how their technology improves accuracy and provides business insights? Review their data security credentials, such as SOC 2 or ISO 27001 certifications, to ensure your data and your clients’ data are protected.

Assess the Partnership and Governance Model

Look for a consultative partner, not a transactional vendor. The right partner will work with you to understand your goals and proactively suggest process improvements.

Ask: What kind of reporting, performance metrics, and quality assurance processes do they provide? Do they offer a dedicated account management team? Look for a cultural fit that emphasizes collaboration and transparency.

The Future of Insurance BPM: AI, Automation, and Analytics

Technology is rapidly transforming insurance BPM services from a labor-based solution to a technology-enabled one. The future lies in the intelligent synergy between human expertise and powerful automation, allowing for unprecedented levels of efficiency and insight.

The Role of Artificial Intelligence (AI)

AI is moving beyond hype and delivering tangible results in insurance operations. In a BPM context, AI can be used for intelligent data extraction from unstructured documents, comparison of forms during policy checking to identify discrepancies, and predictive analytics to spot trends in claims or submissions. This enhances human accuracy and provides business intelligence that was previously impossible to unlock at scale.

Robotic Process Automation (RPA)

RPA “bots” are software programs designed to perform high-volume, rules-based digital tasks, exactly the kind of work that often bogs down insurance teams. RPA is perfect for automating tasks like re-keying data from one system to another, generating renewal letters from a template, or validating data fields against a set of rules. By deploying RPA, a BPM partner can free up their human agents—and yours—to focus on complex, judgment-based work.

Frequently Asked Questions (FAQs)

What is the difference between insurance BPM and a PEO or staff augmentation?

BPM is outcome-focused; you delegate an entire process (e.g., policy checking) to a partner who is responsible for the results, quality, and efficiency. Staff augmentation or a PEO (Professional Employer Organization) is input-focused; you are essentially hiring remote individuals to work under your direct management. A BPM partner takes full ownership of the process itself.

How is data security and regulatory compliance handled by a BPM provider?

A reputable insurance BPM provider makes security and compliance a top priority. They should have robust frameworks and certifications like SOC 2 and ISO 27001, conduct regular audits, provide ongoing staff training on data privacy, and be able to demonstrate how they adhere to industry-specific regulations.

What is the typical implementation process for starting with an insurance BPO service?

The process typically begins with a discovery phase where the BPM partner analyzes your current workflows. This is followed by designing the optimal solution, documenting standard operating procedures (SOPs), and training the dedicated team. A phased rollout or pilot program is often used to ensure a smooth transition before scaling up the engagement.

Are insurance BPM services only for large national carriers?

Not at all. While large carriers are major users, BPM services offer significant value to organizations of all sizes, including regional carriers, MGAs, wholesalers, and large retail agencies. The scalability of the model allows smaller entities to gain access to enterprise-level efficiency and expertise without the enterprise-level cost.

How do you measure the ROI of an insurance BPM partnership?

ROI is measured through a combination of “hard” and “soft” metrics. Hard metrics include direct cost savings on salaries and benefits, reduction in error rates (E&O risk), and increased transaction processing speed. Soft metrics include the value of re-deploying in-house staff to revenue-generating activities, improved employee morale, and enhanced agent or client satisfaction.

Will outsourcing mean we have to lay off our current employees?

Most organizations use BPM as a strategy to enable growth, not to replace their valued team members. By outsourcing repetitive, administrative tasks, you can redeploy your experienced employees to more strategic, high-value roles that directly impact customer relationships, risk analysis, and business development—work they are often more qualified for and engaged by.

Turn operational complexity into competitive advantage.

Contact us to explore how a strategic insurance BPM partnership can optimize your processes and support long-term growth.